Pyrrhotite WARNING in Connecticut (CT).

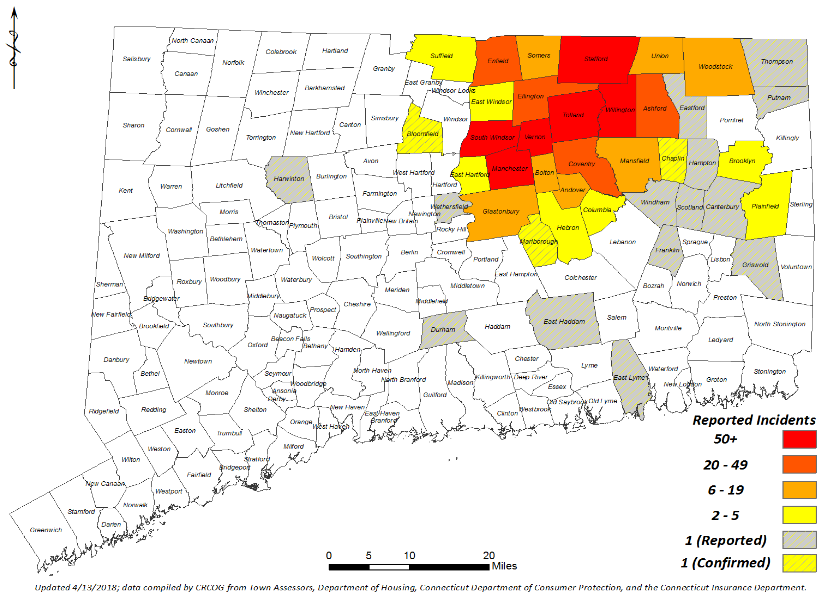

The Connecticut Department of Housing recently posted a bulletin, stating there are upwards of 35,000 Homes and Businesses in the North, East, and Central parts of Connecticut that are facing a potentially devastating issue due to the presence of a naturally occurring Iron Sulfide(Pyrrhotite) originating from a quarry in Willington. The pyrrhotite mineral can cause the slow deterioration of concrete foundations and structures when exposed to oxygen and water. While the presence of pyrrhotite indicates the potential for concrete deterioration, its existence alone does not necessarily cause it. Approximately 41 towns may be affected by what appears to be a slow moving natural disaster. As a structure continues to deteriorate, it often becomes unsound. Cracking, flaking, bowing, and separation of the concrete has already appeared on some homes built between 1983 and 2015. The cracking starts small and can take more than a decade to appear. Cracks that go horizontal or splinter out like a web are the most concerning. A rust color or white powder may appear. The dry wall of a finished basement may need to be removed to examine the concrete, although the damage is often visible on the outside of the home. Below is a map identifying the areas affected by Pyrrhotite in your concrete foundation.

If you own property in Connecticut and suspect that your home may be affected by Pyrrhotite in your concrete foundation, and are starting to see signs of cracking, flaking, bowing, buckling, crumbling, or separation in your Home’s concrete foundation or basement, please contact one of our foundation specialists at Attack A Crack™ (860)573-8760, and we will provide you with a full assessment of your home or business’ concrete foundation. Attack A Crack™ will inspect your concrete foundation’s integrity, and tell you whether it poses a danger to your Family, Home, or Business. We are here to assist with your foundation needs, and can provide you with answers and resources to help you find a solution. Please read below for the latest news released on Pyrrhotite from the Hartford Courant dated Nov 21, 2017.

If you would like to setup a Free Inspection time, please complete the Contact Form below, and we will confirm with you asap. Or, you can call us directly at (860)573-8760, and we’ll be happy to confirm your appointment date right over the phone. Thank you, and have a great day!

CONTACT FORM QUERY

NEWS UPDATES

March 9, 2019:

Banks not telling house buyers about pyrrhotite

By Eric Bedner, ebedner@journalinquirer.com, March 9, 2019

Speakers at a legislative public hearing Friday said banks are selling foreclosed houses without disclosing to the buyers that the houses have pyrrhotite in their foundations.

The revelation came during a joint public hearing before the legislature’s Insurance and Real Estate and Planning and Development committees on several crumbling foundation bills.

One bill would require certain disclosures when selling a home, including whether there is pyrrhotite in the foundation, what testing or repairs have been done, and any deterioration associated with pyrrhotite, the iron-sulfide mineral that is causing foundations to crumble.

As currently written, the proposal would apply to homeowners selling their homes, but not to banks. Some legislators and real estate agents say banks should also be required to disclose foundation problems.

Dan Keune, president of the Connecticut Association of Realtors, said he has shown bank-owned houses that have obvious signs of pyrrhotite-related deterioration. After asking the listing agency if the bank had the foundations tested, Keune said he was told that banks won’t test for the mineral, which expands over time and destroys foundations.

Rep. Thomas Delnicki, R-South Windsor, said a young couple moved into town after buying a house that had been foreclosed on, only to find out later that it had a crumbling foundation.

Delnicki said there is the potential for banks to take advantage of unsuspecting buyers who believe they are getting a great deal on a home.

State Sen. M. Saud Anwar, D-South Windsor, raised concerns about homeowners choosing not to have their homes tested precisely because they would have to disclose the results if they try to sell the house.

Full disclosure by condos

Ellington lawyer Brenda Draghi said the proposed legislation should also include full disclosures by condominium complexes — not just sellers of individual condo units — because other affected units in a complex would affect a condominium owner’s overall financial liability.

Other bills under consideration would require insurance companies to provide coverage for deteriorating foundations, establish an $8 million grant program to develop methods intended to reduce the cost of repairing or replacing foundations, and require quarries throughout the state to be tested for pyrrhotite.

The question of whether insurance companies should provide coverage is also the subject of a lawsuit in which the state Supreme Court is expected to issue a decision this summer.

Eric George, president of the Insurance Association of Connecticut, continues to assert that requiring insurance coverage for foundations would increase the cost of homeowners insurance and affect the availability and affordability of insurance for every homeowner in the state.

The American Property Casualty Insurance Association opposes the legislation for the same reasons.

Willington resident Timothy Heim, who is also president of the Connecticut Coalition Against Crumbling Basements, wants insurance companies to provide coverage and is calling for a Connecticut Unfair Insurance Practices Act investigation.

His efforts stem from insurance policy language being changed to require an abrupt collapse for foundation coverage to apply — and from the way policyholders were notified of the change.

Delnicki said the newly formed bipartisan Crumbling Foundations Caucus is working on a letter to the state insurance commissioner asking for an unfair insurance practices investigation.

Insurers escaped problem.

South Windsor lawyer Keith Yagaloff called the abrupt-collapse requirement an “illusion.” He said insurance companies intentionally changed their language to avoid covering crumbling foundations.

“They went to the insurance commissioner and got permission to change the language,” he said of insurers. “And they basically wrote out coverage for everybody with this condition.”

Proponents of testing all quarries in the state for pyrrhotite say it would help to ensure that the crumbling foundation crisis doesn’t recur. But critics say the proposed testing is repetitive and too costly, potentially putting some quarries out of business.

Legislators are also considering slight language tweaks to legislation already passed. One proposal would allow condominium owners to receive funding from the state’s nonprofit captive insurance company established to assist those with crumbling foundations. Another would ensure that an annual $12 insurance surcharge is charged only once per policy, rather than once per policyholder.

Rep. Christopher Davis, R-Ellington, said it was always the legislature’s intent to have the captive insurance company cover condominiums.

The superintendent of the state’s foundation fund, Michael Maglaras, said “legacy” applicants — those who replaced their foundations but aren’t eligible for captive funds because they no longer live in the home — will soon be able to apply for help.

He stressed the importance of receiving the next $20 million installment of bonding from the state.

Claims outstrip funds at this point, he said, there are $57 million of claim liabilities on the company’s balance sheet but only $18.6 million in available cash.

Maglaras expects the claims to rise to $70 million by the end of April and to $90 million by the end of this fiscal year. Since launching in January, the company has paid out $1.2 million in claims and will pay at least $4.5 million in the next four weeks, he said.

He added that he expects fewer than 30 total legacy claimants and is confident the state fund will be able to help them.

During the brief time the captive company has been operational, Maglaras has determined that the average cost of replacing a foundation, excluding peripheral costs such as landscaping or decks, is about $168,000, which is less than the $175,000 cap on funds provided by the state fund.

Crumbling foundation legislation has been debated in the General Assembly for the last three sessions and is gaining support from lawmakers outside the affected area.

“Even though we don’t have it in my end of the state, we’re behind you 100 percent,” Rep. Kenneth Gucker, D-Danbury, said to the room full of affected homeowners and advocates.

March 8, 2019:

HARTFORD, CT – 03.08.2019 – CRUMBING FOUNDATIONS – Homeowners testified on Friday afternoon at the Legislative Office Building in Hartford in support of several bills to help address and alleviate the crumbing foundations. PATRICK RAYCRAFT | praycraft@courant.com (Patrick Raycraft / Hartford Courant)

HARTFORD, CT – 03.08.2019 – CRUMBING FOUNDATIONS – Homeowners testified on Friday afternoon at the Legislative Office Building in Hartford in support of several bills to help address and alleviate the crumbing foundations. PATRICK RAYCRAFT | praycraft@courant.com (Patrick Raycraft / Hartford Courant)

Homeowners with failing foundations asked state legislators Friday to pass bills that would mandate insurance companies to cover the peril of collapse and require testing for pyrrhotite at the state’s quarries.

At a public hearing on nine bills aimed at assisting homeowners with failing foundations, dozens of homeowners implored lawmakers for the third year to pass the bills and expand protections for victims.

“As an individual devastated financially by this crisis, I’d like to offer this blanket statement: I am in full support of all the bills that will aid homeowners and their communities,” Manchester resident Don Poulin said.

The exterior of the concrete foundation of Maggie and Vincent Perracchio’s home continues to show serious signs of cracking and even collapsing. “This is getting worse and worse and worse,” says Maggie about the crumbling concrete foundation. (Patrick Raycraft/Hartford Courant/TNS) ** OUTS – ELSENT, FPG, TCN – OUTS ** (Patrick Raycraft / TNS)

Crumbling foundations have touched at least 41 towns in Connecticut including South Windsor, Vernon, Tolland and Willington. An estimated 34,000 homeowners could be impacted by the issue, which caused by the mineral pyrrhotite present in the concrete that breakdowns when exposed to air or water. It is believed that most of the faulty concrete came from Becker’s Quarry in Willington and was poured by a now defunct Stafford Springs company.

[Politics] Cancel the cookout: House ‘definitely’ working Saturday, probably Sunday »

Among the proposed legislation are bills that would allow condominiums to apply for funding from the Connecticut Foundation Solutions Indemnity Company (CFSIC) and a bill that would require insurance companies to cover the peril of collapse.

Insurance companies have denied homeowners’ claims, saying the problem does not qualify for coverage under their definition of “collapse.” Homeowners have been left to bear the financial burden of a repair, which can cost as much as $200,000.

Condominium owners were excluded from applying for CFSIC funds because of a loophole in the legislation that defined narrowly defined a residential building.

“Expand the definition of residential buildings,” Vernon resident and victim Debra McCoy said.

One bill homeowners were particularly vocal about would mandate testing by the Department of Consumer Protection for pyrrhotite at the state’s quarries to prevent tainted concrete from being used in the future.

“We need concrete standards for our construction industry,” victim Linda Tofolowsky said. “We desperately need a standard for this industry that has been self regulated for years.”

Other bills would require homeowners in the affected areas who are selling a home built between 1983 and 2017 to do an inspection of their foundation and disclose the presence of pyrrhotite prior to selling. Homes sometimes do not show signs of damage until 15 or 20 years after the foundation was poured, allowing the problem to lie undetected.

February 7, 2019:

CT senators seek funds to fix crumbling foundations

Blumenthal sponsored the “The Crumbling Foundations Small Business and Homeowners Assistance Act of 2019,” which would establish a grant program through the Federal Emergency Management Agency, FEMA, to award funding up to $20 million each year for five years to reimburse affected owners of homeowners, small businesses and others for money spent to prevent, repair and mitigate damage caused by concrete foundations containing pyrrhotite.

About three dozen towns in north-central and northeastern Connecticut — and some areas in nearby Massachusetts — have foundations built with concrete containing pyrrhotite from a quarry in Willington. Pyrrhotite is a mineral that expands with moisture and causes foundations to bow and crack.

FEMA rejected former Gov. Dannel Malloy’s efforts to consider the crumbling foundation crisis a natural disaster that would be eligible for federal disaster relief.

Sens. Edward Markey, D-Mass., and Elizabeth Warren, D-Mass, are co-sponsors of Blumenthal’s bill, as well as separate legislation introduced by Murphy called the “Aid to Homeowners with Crumbling Foundations Act.”

That bill also seeks $100 million over five years to establish a grant program at the U.S. Department of Housing and Urban Development for states like Connecticut that have created non-profit crumbling foundations assistance funds to help homeowners.

Connecticut has a Crumbling Foundations Assistance Fund to allow $100 million in bonding, which would amount to annual payments of $20 million, over the next several years to assist victimized homeowners. Payments from the relief program, which began processing claims last month, are capped at $175,000. That isn’t enough to cover the cost of raising a house and replacing a foundation — estimated at about $250,000 — however, which is why federal relief is needed.

As of now, the only federal help for homeowners with crumbling foundations is the determination by the Internal Revenue Service — sought by Rep. Joe Courtney, D-2nd District, and Connecticut’s U.S. senators – to make an exception to the new federal tax laws that eliminated casualty loss deductions. The IRS announced last February it would allow Connecticut homeowners with crumbling foundations to take advantage of a deduction on qualified home repairs through December 2020.

The senators introduced similar bills in the last Congress, but they did not win final approval.

“The federal government must step up and provide real relief from the unconscionable stress and expense made worse by the unacceptable inaction of many insurance companies.” Blumenthal said.

Murphy agreed.

“While we’ve been successful in getting Congress to take some action,” he said, “it’s not enough.”